Discover everything about IndusInd Bank personal loans. Explore types, approval requirements, and interest rates in this practical guide.

If you are considering the possibility of obtaining a personal loan, IndusInd Bank might be an attractive option. This practical guide provides a comprehensive overview of the personal loans offered by this bank, helping you understand the different types, the requirements for approval, and the interest rates involved.

Types of Personal Loans

IndusInd Bank offers various types of personal loans, catering to the needs of different clients. Here are some available options:

1. Conventional Personal Loans

These loans are ideal for general expenses such as travel, weddings, or education. The approval process is usually quick, and funds can be made available rapidly, making them a convenient choice for those in need of immediate financial support.

2. Debt Consolidation Loans

If you have multiple debts and are struggling to manage them, IndusInd Bank offers loans specifically designed for debt consolidation. This allows you to combine all your debts into a single payment, potentially at a lower interest rate. This can simplify your financial management and reduce your monthly payments.

3. Emergency Loans

These loans are designed to address urgent financial needs. The approval can be quick, enabling you to access the funds you need within a short time frame. They are especially useful for unexpected expenses, such as medical emergencies or urgent repairs.

4. Educational Loans

IndusInd Bank also provides educational loans to help students fund their higher education. These loans often come with flexible repayment options and competitive interest rates, making it easier for students to pursue their academic goals without financial burden.

5. Home Renovation Loans

For those looking to renovate or upgrade their homes, IndusInd Bank offers loans specifically tailored for home improvement projects. These loans can help you finance renovations, enhancing your living space and potentially increasing your property’s value.

Approval Requirements

To ensure the approval of your personal loan at IndusInd Bank, you must meet several basic requirements. Here are the main criteria:

1. Minimum Age

Applicants must be at least 21 years old and not older than 58 years. This age range ensures that borrowers are in a stable phase of their lives.

2. Minimum Income

The bank requires applicants to have a minimum monthly income. This requirement guarantees that you have the capacity to repay the loan installments comfortably.

3. Required Documentation

You will need to provide documents that verify your identity, residence, and income. This may include:

- Copy of your identification document (such as a government-issued ID or passport)

- Proof of residence (utility bill, lease agreement, etc.)

- Proof of income (salary slip, income tax return, etc.)

4. Credit History

A good credit history is essential for loan approval. The bank will review your credit score to assess your creditworthiness. A higher credit score can lead to better loan terms.

Interest Rates

The interest rates for personal loans at IndusInd Bank can vary based on several factors, including your income, credit history, and the amount requested. On average, rates may range from 10% to 20% per annum. It is important to remember that a lower interest rate may be offered to customers with a good credit history.

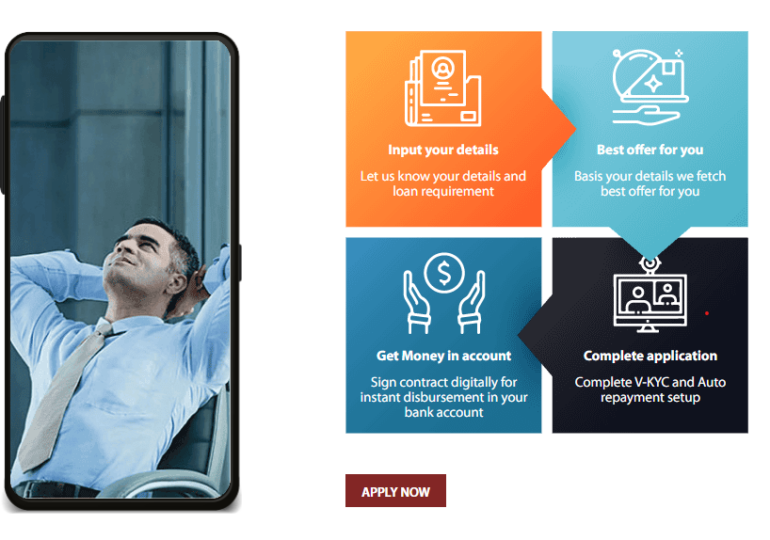

Application Process

The process of applying for a personal loan at IndusInd Bank is straightforward and can be done both online and at physical branches. Here’s a step-by-step guide:

1. Fill Out the Application Form

You can visit the IndusInd Bank website and fill out the personal loan application form. Make sure to provide all necessary information accurately to avoid delays.

2. Documentation

After filling out the form, you will need to submit the required documents. This can be done digitally or physically, depending on your chosen application method.

3. Credit Evaluation

The bank will conduct a review of your credit history and repayment capacity. This evaluation is crucial for loan approval and helps the bank assess the risk of lending to you.

4. Approval and Fund Disbursement

If your application is approved, the funds will be released quickly, usually within a few business days. This prompt disbursement ensures you can access the money when you need it most.

Conclusion

IndusInd Bank’s personal loans can be an excellent solution to meet your financial needs. With various options available, a simple application process, and accessible requirements, the bank stands out as an attractive choice for those seeking a personal loan. Before making any decisions, it is advisable to compare interest rates and terms offered by other banks to ensure you make the best choice for your financial situation.